Dividends from a stock insurance company are normally sent to Idea

Home » Trending » Dividends from a stock insurance company are normally sent to IdeaYour Dividends from a stock insurance company are normally sent to images are ready. Dividends from a stock insurance company are normally sent to are a topic that is being searched for and liked by netizens today. You can Find and Download the Dividends from a stock insurance company are normally sent to files here. Find and Download all free vectors.

If you’re searching for dividends from a stock insurance company are normally sent to images information related to the dividends from a stock insurance company are normally sent to keyword, you have pay a visit to the ideal site. Our site frequently gives you hints for viewing the highest quality video and image content, please kindly hunt and locate more enlightening video content and images that fit your interests.

Dividends From A Stock Insurance Company Are Normally Sent To. While a stock insurer technically could pay policyholder dividends as well, few if any do. For example, cvs health pays an annual dividend of $2.00. The obvious way that insurance companies can make money is by selling insurance policies and bringing in more money in premiums than they pay out as claims. A dividend is paid per share of stock — if you own 30 shares in a company and that company pays $2 in annual cash dividends, you will receive $60 per year.

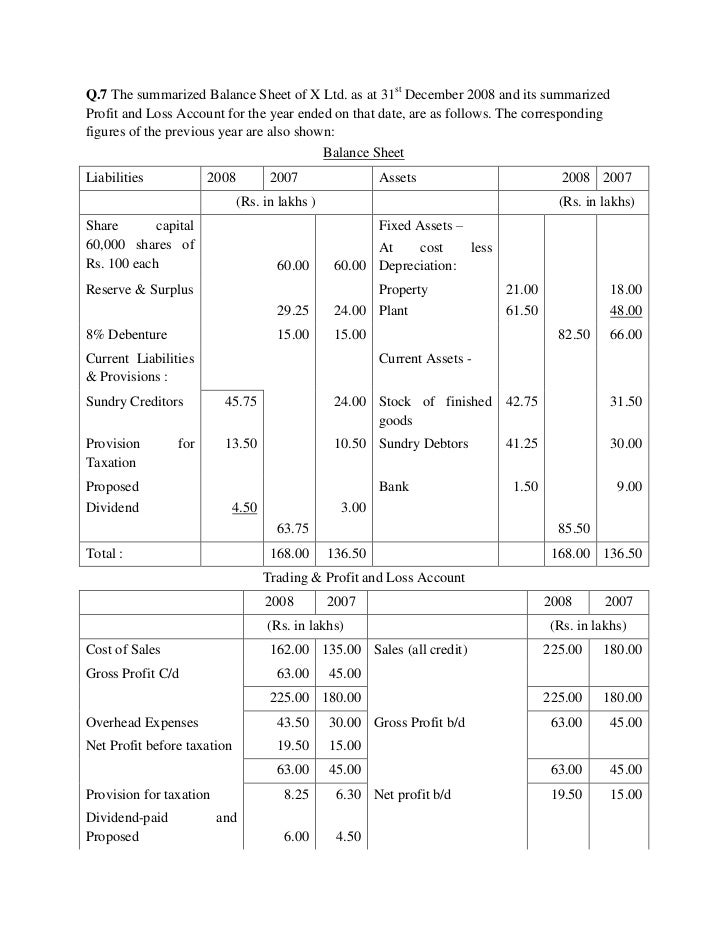

Owen Company�s unadjusted book balance June 30 s 39.460 From homeworklib.com

Owen Company�s unadjusted book balance June 30 s 39.460 From homeworklib.com

To be clear, this money isn’t a capital gain, which. Dividend stocks what are dividend stocks? You simply divide the annual payment by four to arrive at the quarterly payment. Companies usually pay out dividends in cash. It has only offered dividends since 2017, and its total liabilities are high, but it has an annual yield of 8.5%, and pays dividends twice a year. The obvious way that insurance companies can make money is by selling insurance policies and bringing in more money in premiums than they pay out as claims.

When a company pays a dividend, each share of stock of the company you own entitles you to a set dividend payment.

A stock insurer pays stockholder dividends; Dividend stocks are stocks that send you a sum of money (usually quarterly, but sometimes annually) simply. This article deals with cash dividends on common stock. To be clear, this money isn’t a capital gain, which. Dividend stocks what are dividend stocks? That could be appealing for investors seeking the top dividend stocks uk.

Source: slideshare.net

Source: slideshare.net

Typically paid quarterly, dividends are like a reward for investing your money into a company’s venture. A risk retention group (rrg) usually pays taxes to the state guarantee association. Types of dividends usually, dividends. Companies usually pay out dividends in cash. But it also takes other forms.

Source: businessinsider.com

Dividend stocks what are dividend stocks? This article deals with cash dividends on common stock. A company usually issues a stock dividend when it does not have the cash available to issue a normal cash dividend, but still wants to give the appearance of having issued a payment to investors. But it also takes other forms. Dividend stocks what are dividend stocks?

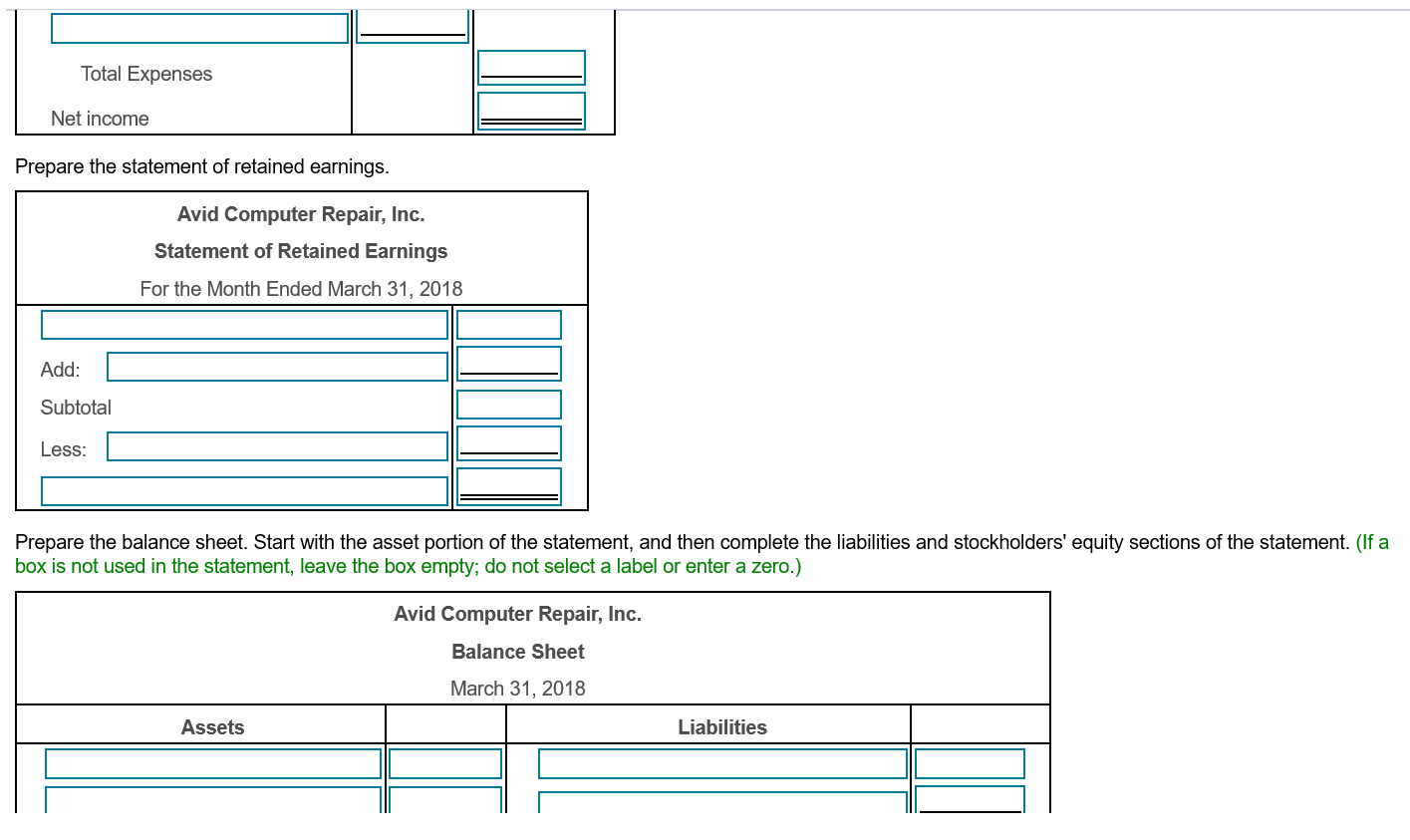

Source: accounting-services.net

Source: accounting-services.net

The board of directors of a company decides if it will declare a dividend, howread more You simply divide the annual payment by four to arrive at the quarterly payment. A mutual insurer pays policyholder dividends. Evraz is among the best dividend stocks in recent years. Dividend stocks what are dividend stocks?

Source: chegg.com

Source: chegg.com

The obvious way that insurance companies can make money is by selling insurance policies and bringing in more money in premiums than they pay out as claims. Dividend stocks what are dividend stocks? A stock dividend is the issuance by a corporation of its common stock to shareholders without any consideration. However, based upon only the cumulative monthly dividends, the annual dividend has been increased for 11 years. Dividend stocks are stocks that send you a sum of money (usually quarterly, but sometimes annually) simply.

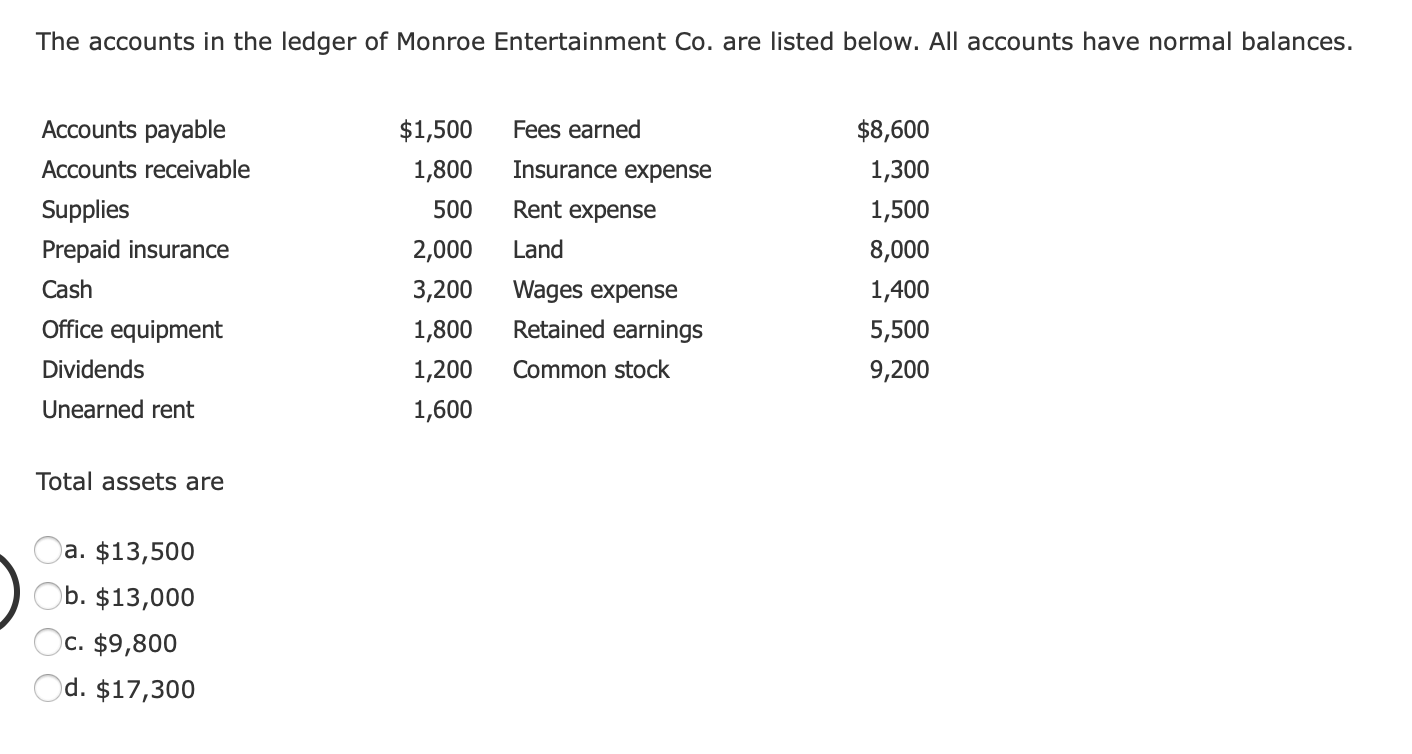

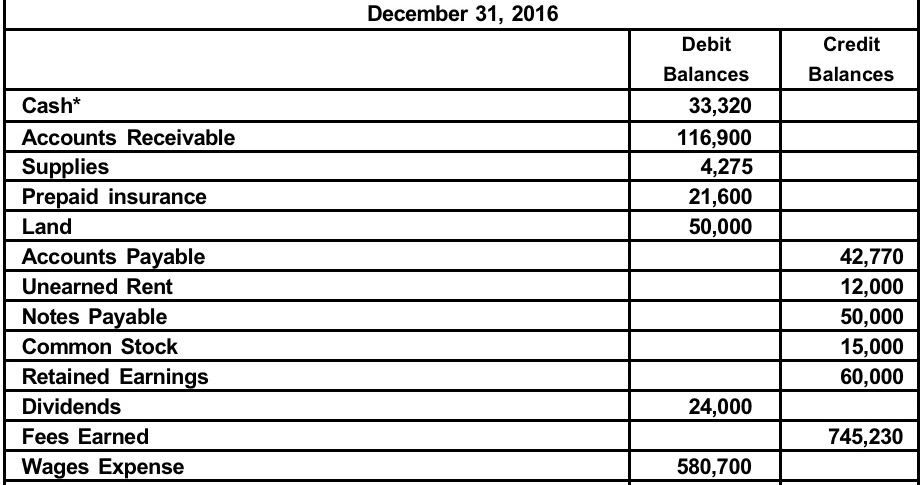

Source: theaccountingpath.org

Source: theaccountingpath.org

Two paragraphs also discuss dividends on mutual fund shares. Dividends can be cash, additional shares of stock or even warrants to buy stock. A dividend is usually declared quarterly after a company finalizes its income statement and dividends are paid either by check or in additional shares of. The obvious way that insurance companies can make money is by selling insurance policies and bringing in more money in premiums than they pay out as claims. When a company pays a dividend, each share of stock of the company you own entitles you to a set dividend payment.

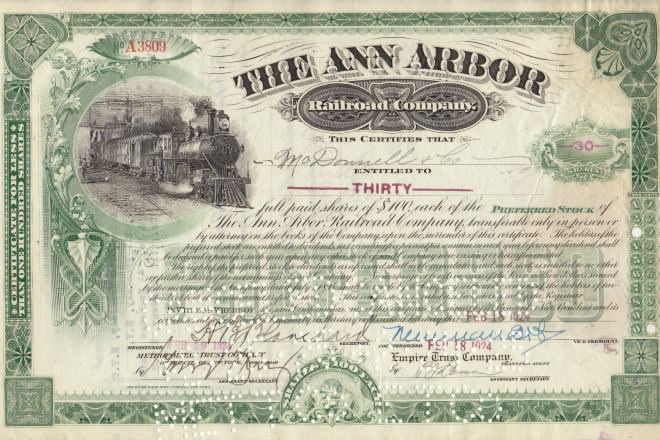

Source: partners4prosperity.com

Source: partners4prosperity.com

A stock dividend is the issuance by a corporation of its common stock to shareholders without any consideration. A risk retention group (rrg) is a mutual insurance company formed to insure people in the same business, occupation, or profession (e.g., pharmacists, dentists, or engineers). It has only offered dividends since 2017, and its total liabilities are high, but it has an annual yield of 8.5%, and pays dividends twice a year. Dividend stocks are stocks that send you a sum of money (usually quarterly, but sometimes annually) simply. Dividends are payments companies make to their stockholders to share their profits.

Source: ayusyahomehealthcare.com

Source: ayusyahomehealthcare.com

Dividend stocks what are dividend stocks? You invest with us now, and we’ll give you something—a dividend—later. Dividend stocks what are dividend stocks? The board of directors of a company decides if it will declare a dividend, howread more It has only offered dividends since 2017, and its total liabilities are high, but it has an annual yield of 8.5%, and pays dividends twice a year.

Source: blog.pdffiller.com

Source: blog.pdffiller.com

Dividend stocks are stocks that send you a sum of money (usually quarterly, but sometimes annually) simply for owning shares in the company. A dividend is paid per share of stock — if you own 30 shares in a company and that company pays $2 in annual cash dividends, you will receive $60 per year. A company usually issues a stock dividend when it does not have the cash available to issue a normal cash dividend, but still wants to give the appearance of having issued a payment to investors. A stock insurer pays stockholder dividends; The board of directors of a company decides if it will declare a dividend, howread more

Source: chegg.com

Source: chegg.com

It has only offered dividends since 2017, and its total liabilities are high, but it has an annual yield of 8.5%, and pays dividends twice a year. The annual total dividend was lower in 2020 than in 2019 since a special dividend was not paid in 2020. A mutual insurer pays policyholder dividends. But it also takes other forms. While a stock insurer technically could pay policyholder dividends as well, few if any do.

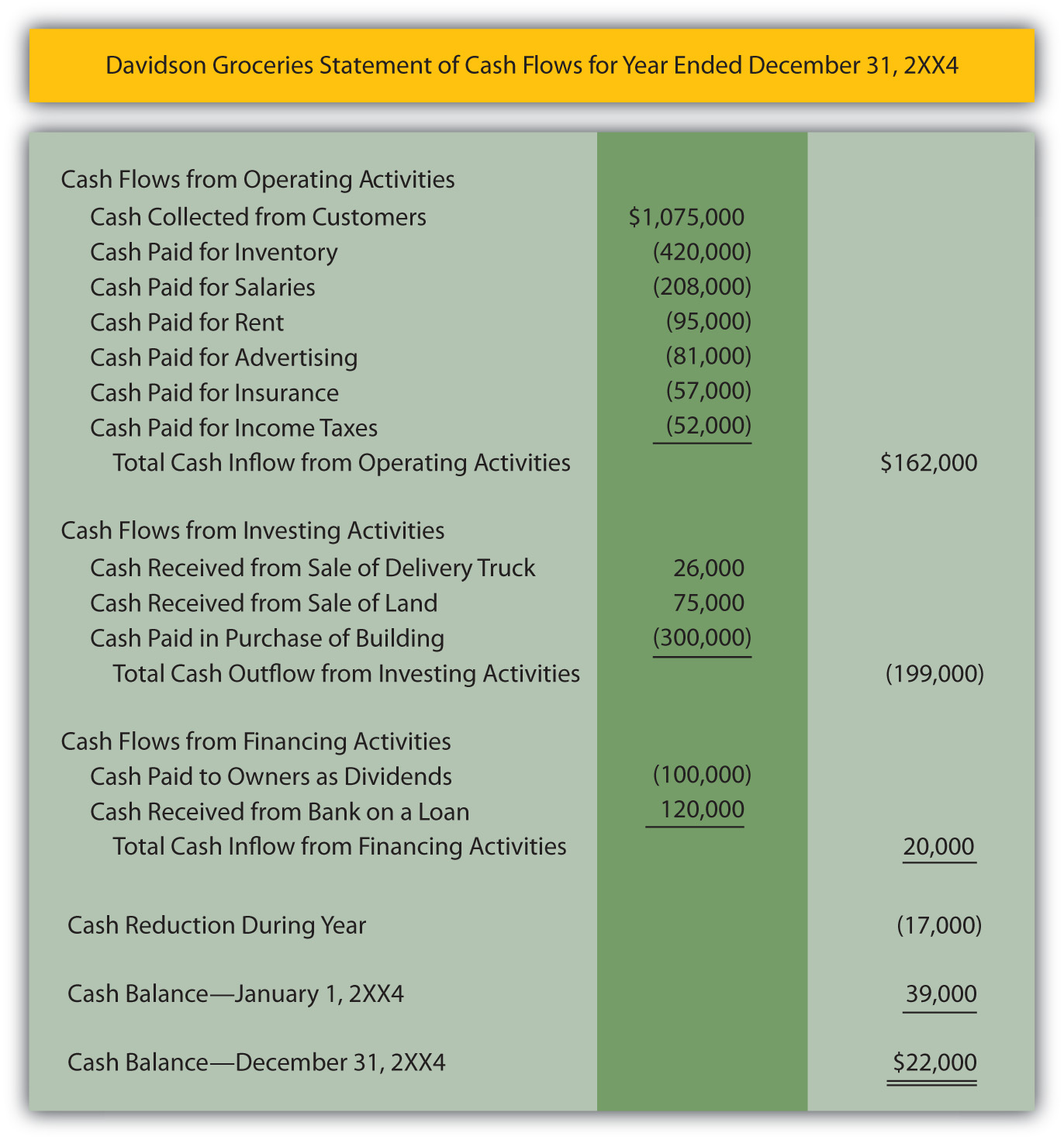

Source: saylordotorg.github.io

Source: saylordotorg.github.io

In the insurance industry, an annual dividend is a yearly payment given by an insurance company to a policyholder. Dividends can be cash, additional shares of stock or even warrants to buy stock. A dividend is usually declared quarterly after a company finalizes its income statement and dividends are paid either by check or in additional shares of. Dividend stocks are stocks that send you a sum of money (usually quarterly, but sometimes annually) simply for owning shares in the company. While a stock dividend is paid out in the form of company shares, a cash dividend is paid out in cash.

Source: prnewswire.com

Source: prnewswire.com

Dividend stocks are stocks that send you a sum of money (usually quarterly, but sometimes annually) simply. This article deals with cash dividends on common stock. Insurance is also issued by fraternal benefit societies, which have existed in the united states for more than a. A separate article elsewhere in this faq discusses stock splits and stock dividends. Types of dividends usually, dividends.

Source: gabrielbarbosadesouza15.blogspot.com

Source: gabrielbarbosadesouza15.blogspot.com

Dividend stocks what are dividend stocks? This article deals with cash dividends on common stock. The amount paid as dividends varies between companies. A separate article elsewhere in this faq discusses stock splits and stock dividends. You simply divide the annual payment by four to arrive at the quarterly payment.

Source: slideshare.net

Source: slideshare.net

A company usually issues a stock dividend when it does not have the cash available to issue a normal cash dividend, but still wants to give the appearance of having issued a payment to investors. While a stock dividend is paid out in the form of company shares, a cash dividend is paid out in cash. Typically paid quarterly, dividends are like a reward for investing your money into a company’s venture. Dividend stocks what are dividend stocks? Types of dividends usually, dividends.

Source: finmanaccqa.blogspot.com

Source: finmanaccqa.blogspot.com

This article deals with cash dividends on common stock. Dividend stocks are stocks that send you a sum of money (usually quarterly, but sometimes annually) simply. Insurance companies are most often organized as either a stock company or a mutual company. Insurance is also issued by fraternal benefit societies, which have existed in the united states for more than a. A risk retention group (rrg) usually pays taxes to the state guarantee association.

Source: homeworklib.com

Source: homeworklib.com

A risk retention group (rrg) is a mutual insurance company formed to insure people in the same business, occupation, or profession (e.g., pharmacists, dentists, or engineers). However, based upon only the cumulative monthly dividends, the annual dividend has been increased for 11 years. Dividend stocks what are dividend stocks? Dividends can be cash, additional shares of stock or even warrants to buy stock. While a stock dividend is paid out in the form of company shares, a cash dividend is paid out in cash.

Source: qbscott.com

Source: qbscott.com

When a company pays a dividend, each share of stock of the company you own entitles you to a set dividend payment. Dividing the annual amount by four gives you. A dividend is paid per share of stock — if you own 30 shares in a company and that company pays $2 in annual cash dividends, you will receive $60 per year. The annual total dividend was lower in 2020 than in 2019 since a special dividend was not paid in 2020. That could be appealing for investors seeking the top dividend stocks uk.

Source: contentkenya.blogspot.com

It has only offered dividends since 2017, and its total liabilities are high, but it has an annual yield of 8.5%, and pays dividends twice a year. Insurance companies are most often organized as either a stock company or a mutual company. A dividend is paid per share of stock — if you own 30 shares in a company and that company pays $2 in annual cash dividends, you will receive $60 per year. That could be appealing for investors seeking the top dividend stocks uk. The obvious way that insurance companies can make money is by selling insurance policies and bringing in more money in premiums than they pay out as claims.

Source: diffen.com

Source: diffen.com

While a stock insurer technically could pay policyholder dividends as well, few if any do. Insurance companies are most often organized as either a stock company or a mutual company. A stock dividend is the issuance by a corporation of its common stock to shareholders without any consideration. A risk retention group (rrg) usually pays taxes to the state guarantee association. A company usually issues a stock dividend when it does not have the cash available to issue a normal cash dividend, but still wants to give the appearance of having issued a payment to investors.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title dividends from a stock insurance company are normally sent to by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea